Jump to: Accessing Financial Benefits and Support | Persons with Disabilities | Ontario Coalition of Indigenous People

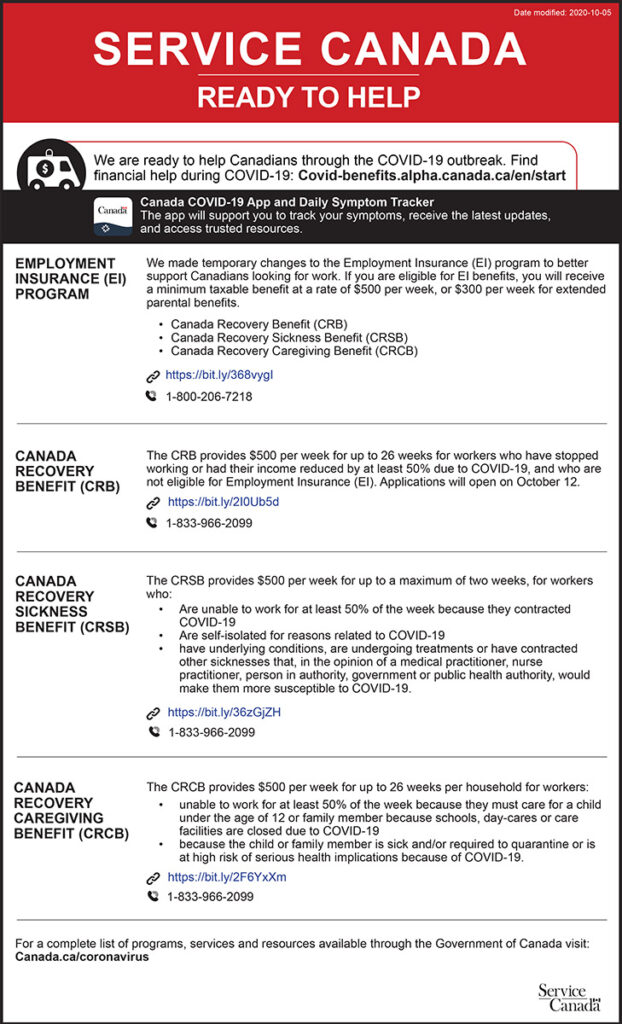

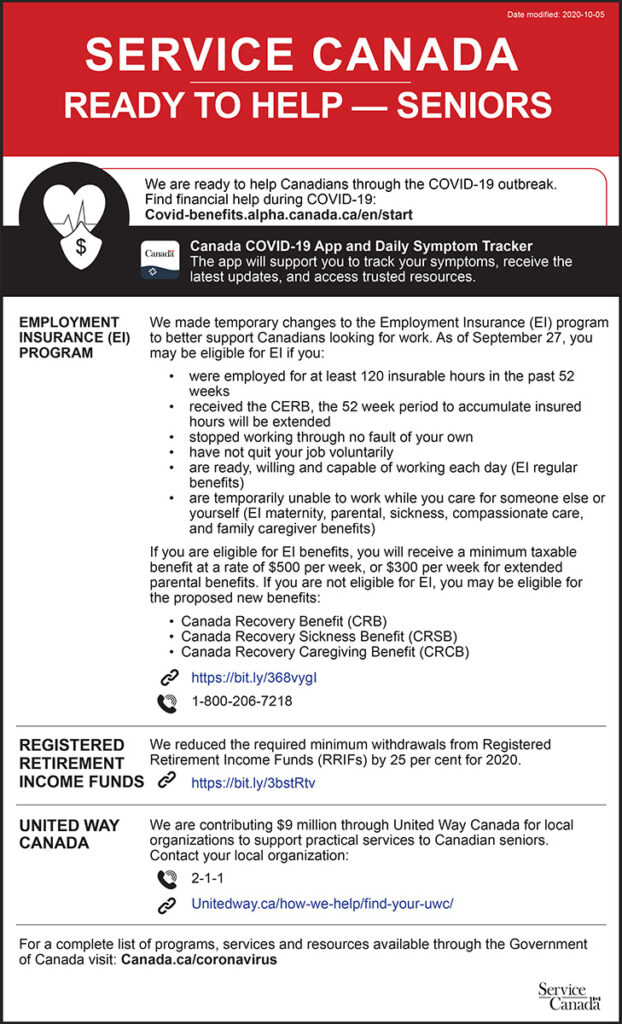

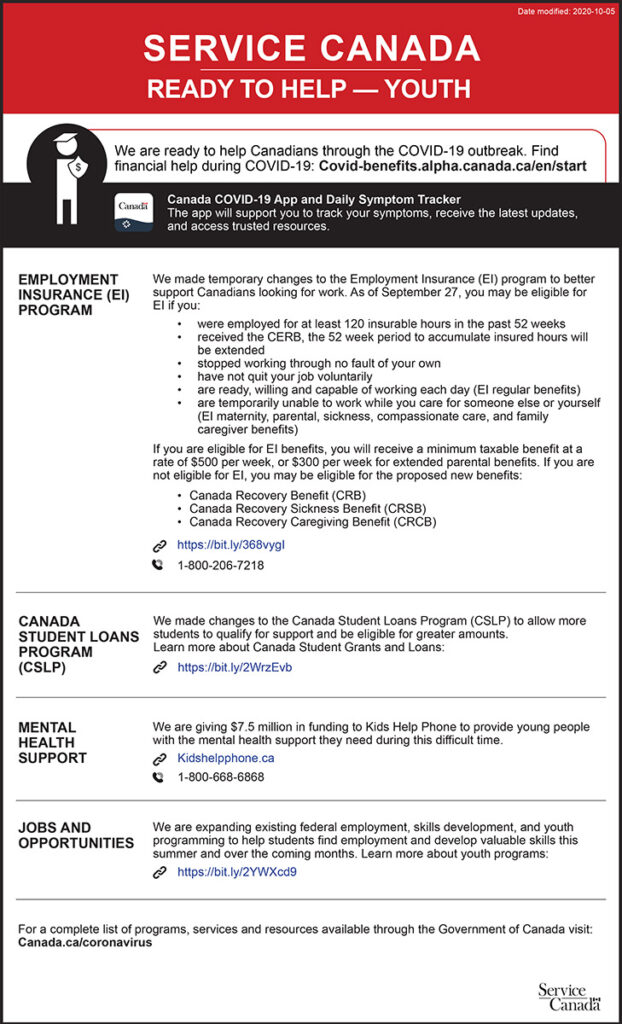

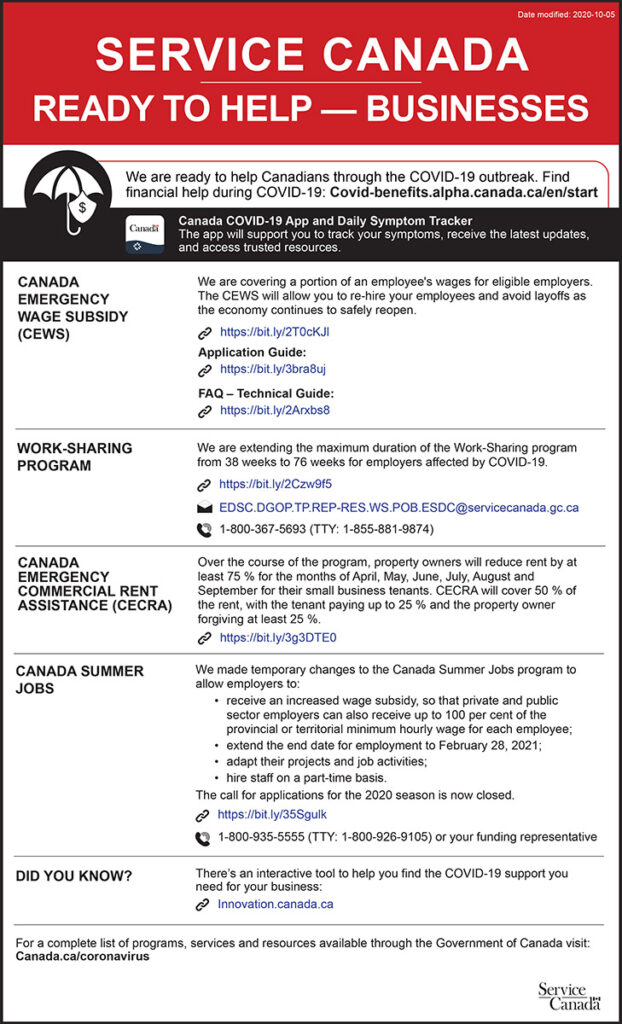

Accessing Financial Benefits and Support

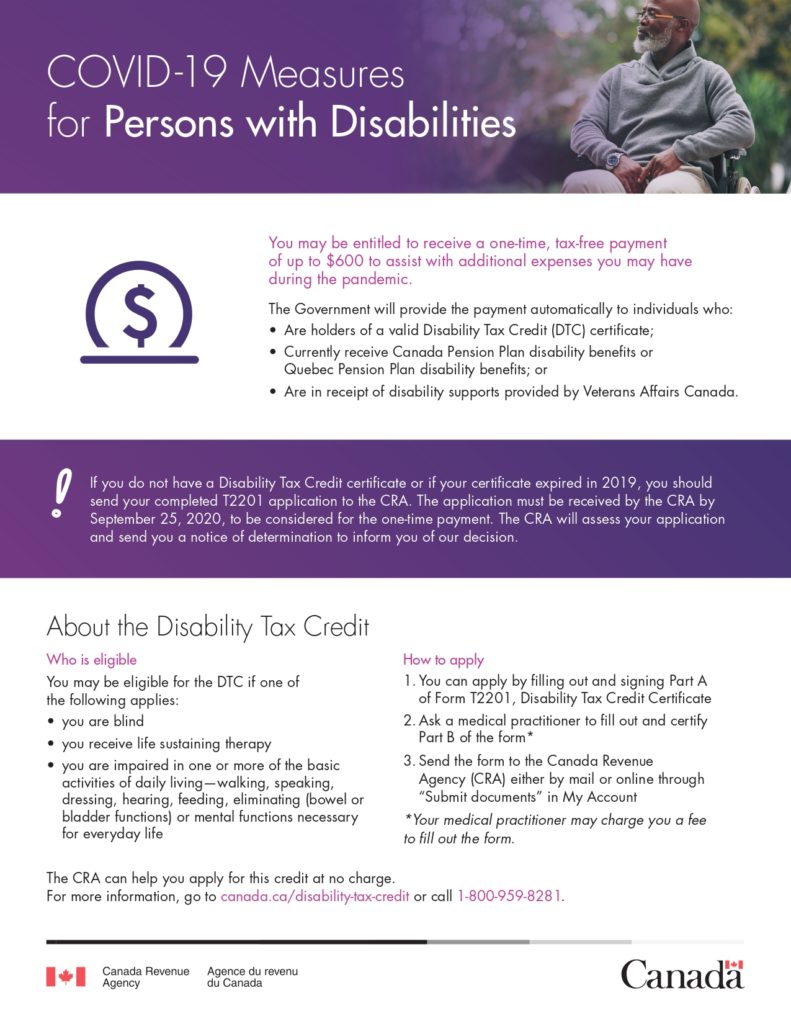

COVID-19 Measures for Persons with Disabilities

Ontario Coalition for Indigenous People (OCIP)

Eligibility: Metis, non status, status off reserve and Inuit people (who have no other covid funding source)

Funds will only be available for February and March 2022

Per month Household essential goods (Food etc.)

- $600 – Single

- $700 – Couple

- $800 – Family + $200 per child 16 years of age and under + transportation allowances

- Also 25% of rent or mortgage and Education allowances

OCIP Website